Elysee Development Corp. is a diversified investment and venture capital firm with a focus on publicly traded companies in the natural resource sector.

With a management team experienced in the financing of resource projects on a worldwide basis, Elysee has been able to identify and capitalize on the exceptional opportunities that have become available in the commodity and precious metals sector. Our investment portfolio currently consists of equity investments in small to medium sized public and private companies, with a focus on precious metals, and includes investments in convertible debentures of various growth companies that provide security of capital and regular income along with the potential for capital appreciation.

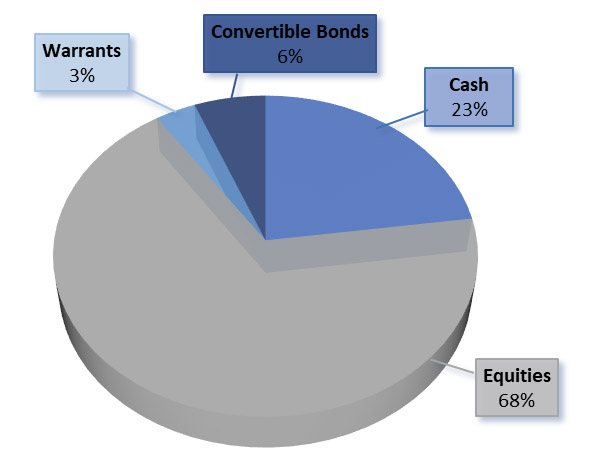

As of September 30, 2025 our portfolio consisted of:

|

Cash and Equivalents |

$5.0 Million |

|

Equities |

$14.9 Million |

|

Warrants |

$0.8 Million |

|

Convertible Bonds |

$1.3 Million |

|

|

$22.0 Million |

Allocation of Investments

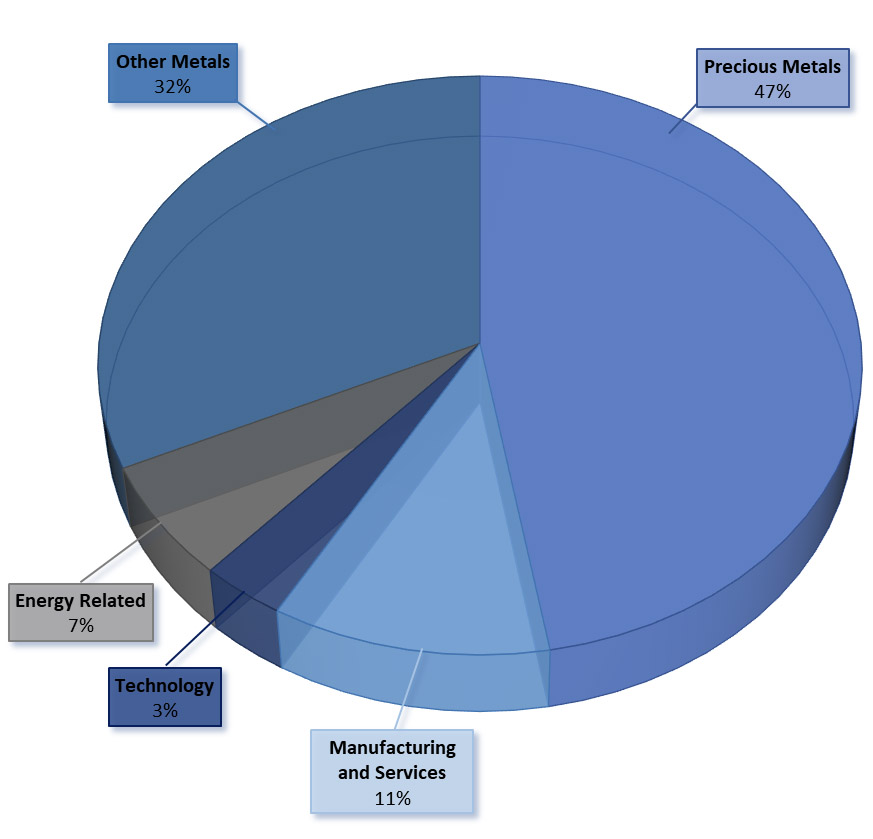

Equity & Convertible Debt Investments by Sector

Use of Non-GAAP Financial Measures

This web site contains references to Net Asset Value (“NAV”), a non-GAAP (generally accepted accounting principles) measure calculated as the value of total assets less the value of total liabilities divided by the total number of common shares outstanding as at a specific date. For the purpose of this calculation, share purchase warrants held by Elysee were valued using the Black-Scholes model calculation, as reported in our annual and quarterly financial statements. The term NAV does not have any standardized meaning according to GAAP and therefore may not be comparable to similar measures presented by other companies. There is no comparable GAAP measure presented in Elysee’s consolidated financial statements and thus no applicable quantitative reconciliation for such non-GAAP financial measure. The Company believes that NAV can provide information useful to its shareholders in understanding its performance, and may assist in the evaluation of its business relative to that of its peers.